Stock Momentum & Analyst Sentiment

Wall Street analysts remain generally bullish to moderately optimistic on Rocket Lab’s stock:

- Many brokerages maintain Buy or Overweight ratings, with price targets ranging roughly from ~$58 up to ~$75 or more — suggesting potential upside from current levels. GuruFocus+1

- Average consensus price targets imply mid-teens to ~50%+ upside in the next 12 months for RKLB stock. GuruFocus

However, some platforms show more conservative projections (~$49–$60), highlighting that gains are not guaranteed and depend on execution and market conditions. MarketBeat

What’s Driving RKLB’s Potential

1. Neutron Rocket Launch Outlook

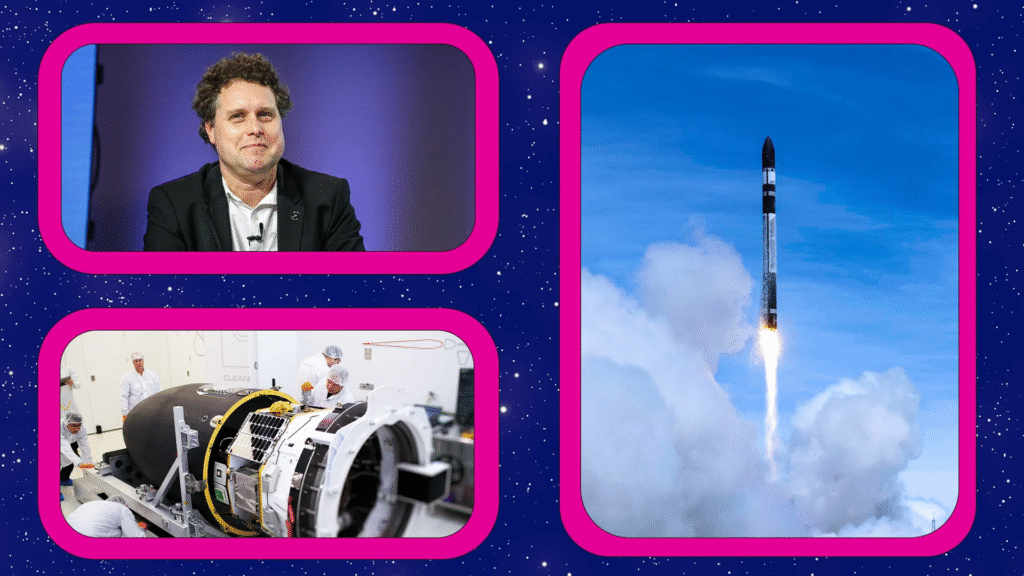

Rocket Lab is gearing up for the first flight of its larger, partially reusable Neutron rocket, aimed at competing with SpaceX’s Falcon 9 in the medium-lift launch segment. This next-generation launch vehicle is a major growth catalyst — if successful, it could unlock bigger contracts and recurring revenue streams. TipRanks

2. Growing Contracts & Partnerships

Recent news highlights:

- Rocket Lab completed final tests on a key reusable fairing component for Neutron. Space

- A Korean satellite launch was postponed but remains on Rocket Lab’s 2025 manifest. Space

- Long-term government and commercial launch deals (including multi-mission contracts) have supported strong industry demand in 2025. Investopedia

Some analysts also spotlight potential government and defense space contract opportunities, which could significantly boost revenue if realized. MarketWatch

Price Prediction Outlook

Short-Term (Next 3–12 Months)

Most analyst price targets in late 2025–early 2026 cluster between $55–$75+, indicating possible upside of 10–50%+ from current levels. GuruFocus+1

Medium-Term (2026 and Beyond)

Some industry forecasts — including from Motley Fool and other outlets — suggest Rocket Lab could rise significantly through 2026 and beyond if:

- Neutron launches succeed commercially

- Space sector demand increases

- Defence and government contracts expand

While precise long-term price targets vary widely, the narrative among bullish forecasts is that successful execution could lift RKLB beyond historical highs seen in past years. Nasdaq

Risks to Keep in Mind

- Execution risk: Delays or failures in rocket development could weigh on stock price.

- Profitability concerns: Rocket Lab has yet to post consistent profits — a common challenge for high-growth aerospace names.

- Market volatility: Aerospace stocks can swing sharply with macro conditions and investor sentiment.

Many more cautious models emphasize the importance of fundamentals and risk management for RKLB’s valuation. insight-room for The Investor

Will RKLB Reach New Highs?

Rocket Lab has strong growth catalysts — Neutron rocket, government contracts, and expanding launch services — that could push RKLB to new highs if milestones are achieved. Analyst forecasts generally point to upside from current levels, especially over a 12-month horizon, though results depend on execution and broader market conditions.

Bullish Scenario:

- Price may climb toward upper price targets ($60–$75+).

- Success of Neutron and new contracts could be key triggers.

Bearish/Cautious Scenario:

- Delays, technical risks, or broader market sell-offs could keep RKLB sideways or below recent peaks.

This update is for informational purposes and not financial advice. Stocks involve risk — consider your investment goals and consult a financial advisor before making decisions.

RKLB Stock – Key Information & Current Outlook

| Category | Details |

|---|---|

| Company Name | Rocket Lab USA, Inc. |

| Ticker Symbol | RKLB |

| Exchange | NASDAQ |

| Sector | Aerospace & Defense |

| Industry | Space Launch & Satellite Systems |

| Founded | 2006 |

| Headquarters | Long Beach, California, USA |

| CEO | Peter Beck |

| Flagship Rocket | Electron (small satellite launch) |

| Upcoming Rocket | Neutron (medium-lift, reusable) |

| Why RKLB Is Trending | Neutron rocket progress, rising space demand, government contracts |

| Main Growth Catalyst | Successful Neutron launch + defense & NASA contracts |

| Current Market Sentiment | Bullish to Moderately Bullish |

| Analyst Rating Trend | Mostly Buy / Overweight |

| Short-Term Price Outlook | Moderate upside with volatility |

| 12-Month Price Target Range | ~$55 – $75 (analyst estimates) |

| Long-Term Potential | Strong if Neutron succeeds commercially |

| Major Risks | Launch delays, high expenses, market volatility |

| Suitable For | Long-term growth & high-risk investors |

| Competition | SpaceX, Blue Origin, Relativity Space |

RKLB is considered a high-growth space stock with strong upside potential, driven mainly by its Neutron rocket program and increasing government interest in private space companies. However, it remains a volatile investment, best suited for investors with a long-term view.

#RKLB #RocketLab #RKLBStock #SpaceStocks #NASDAQStocks #Carrerbook#Anslation#USStockMarket #GrowthStocks #TechStocks #StockPricePrediction #Investing2025