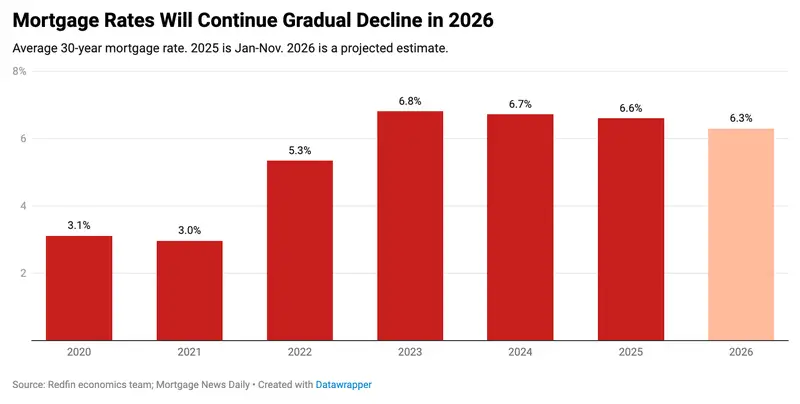

The mortgage interest rate climate in 2026 looks completely different than it did just a few years ago. After the ultra-low rates of 2020 and 2021 — when rates regularly dipped below 3% — the housing market and U.S. economy have gone through major transformations. Inflation surged in 2022, Federal Reserve rate hikes followed, and borrowing costs climbed sharply.

But things finally began shifting in 2024 and 2025. As inflation slowly cooled, the Federal Reserve cut interest rates multiple times, including three reductions in the final months of 2024 and again in late 2025. That shift helped push mortgage rates downward, giving homebuyers hope — and making early 2026 a far more promising time to shop for a home loan.

Even though mortgage rates aren’t back to pandemic lows, today’s environment is much more buyer-friendly than the peak-cost years. Understanding what counts as a “good mortgage rate” right now can help you buy confidently — or refinance strategically — in today’s housing market.

Why Rates Declined From 2024 to 2026

The mortgage rate environment in the United States didn’t fall suddenly — it shifted gradually over two years. After the dramatic rate increases of 2022 and early 2023, many potential homebuyers stayed on the sidelines, waiting for relief. By mid-2024, the economic landscape finally began supporting lower borrowing costs, and that trend continued steadily into 2025 and early 2026. Several major forces played a significant role in that shift, and understanding them can help buyers feel more confident about why today’s rates look more affordable.

Inflation Finally Cooled

One of the biggest reasons mortgage rates have eased is that inflation has slowly dropped from its 40-year highs. When inflation rises, purchasing power weakens, and lenders raise rates to protect against future value loss. In 2022, food, fuel, housing, and everyday costs spiked at the fastest pace since the early 1980s, putting intense pressure on the Federal Reserve and financial markets.

By late 2023 and throughout 2024, inflation began to decline thanks to supply chain recovery, slower consumer spending, and government tightening policies. As inflation cooled, confidence returned to financial markets. Investors were more willing to buy mortgage-backed securities, and lenders no longer needed to raise rates aggressively to hedge risk. This easing inflation directly translated into cheaper long-term borrowing costs, setting the stage for declining mortgage rates moving into 2025 and 2026.

Aggressive Federal Reserve Rate Cuts

The Federal Reserve’s actions were another major catalyst for improving mortgage affordability. After raising interest rates sharply from 2022 through most of 2023, the Fed recognized that inflation was moving toward its 2% target and reversed direction.

At the end of 2024, the central bank cut interest rates three times, signaling strong confidence that inflation was manageable. When price growth remained under control in early 2025, the Fed repeated that approach and issued three more rate cuts toward the end of 2025.

Now, mortgage rates don’t perfectly match the Fed’s movements because mortgages respond to bond market activity, loan demand, and investor outlook. But the Fed’s direction sets the tone. As benchmark rates fall, banks and lenders lower consumer borrowing costs — including those tied to home loans, refinance products, and home equity lines.

By early 2026, these policy shifts helped bring mortgage rates down by nearly a full percentage point from where they stood at the start of 2025, making homeownership more accessible again.

Housing Market Adjustment & Competition

For several years, the U.S. housing market struggled with limited inventory, fast-rising home prices, and intense bidding wars. When rates spiked between 2022 and 2023, many homeowners refused to sell, worried about leaving their ultra-low pandemic mortgages and trading them for much higher rates. This worsened inventory shortages and kept prices elevated.

But in 2024 and 2025, the housing supply picture slowly changed. More homes came on the market, builders increased construction output, and buyer demand cooled during the rate spike years. As the number of listings improved and competition normalized, lenders and sellers had to work harder for business. That shift promoted more competitive lending conditions, helping push mortgage rates lower and contributing to better negotiation power for qualified buyers.

Improving Economic Stability

Finally, the broader economy supported a calming of mortgage rates. Throughout 2024 and 2025:

- Employment levels remained strong

- Wage growth stayed healthy

- Consumer savings and credit strength improved

When borrowers look financially stable, lenders feel less risk issuing long-term loans. A strong job market typically ensures fewer mortgage defaults and stronger homebuyer confidence, which allows mortgage providers to offer lower, more attractive rates.

What Counts as a Good Mortgage Interest Rate in 2026?

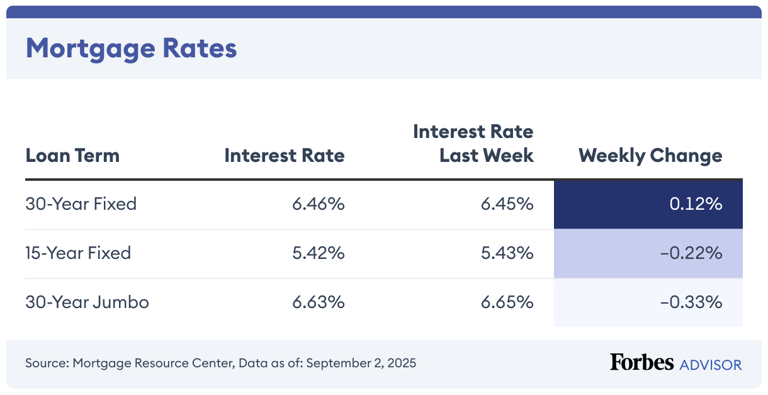

According to current lender averages:

- 30-year fixed mortgage: around 5.87%

- 15-year fixed mortgage: around 5.25%

These are national averages, meaning some lenders will quote higher, and others will go lower.

If you’re offered a mortgage rate below those averages — especially by a meaningful amount — that is considered a good or even excellent rate in early 2026.

While these numbers aren’t close to the sub-4% rates buyers enjoyed earlier in the decade, they are still historically normal — and much lower than the peaks seen when inflation was hottest.

Current mortgage rates data:

30-year conventional

| Current rate | 6.138% |

| One week ago | 6.159% |

| One month ago | 6.238% |

30-year jumbo

| Current rate | 6.427% |

| One week ago | 6.335% |

| One month ago | 6.446% |

30-year FHA

| Current rate | 5.988% |

| One week ago | 6.016% |

| One month ago | 6.072% |

30-year VA

| Current rate | 5.764% |

| One week ago | 5.759% |

| One month ago | 5.833% |

30-year USDA

| Current rate | 5.925% |

| One week ago | 5.975% |

| One month ago | 6.038% |

15-year conventional

| Current rate | 5.469% |

| One week ago | 5.330% |

| One month ago | 5.523% |

Comparing rates on different types of loans and shopping around with different lenders are both important steps in getting the best mortgage for your situation.

#MortgageRates2026 #USAHousing #HomeLoanTips #BestInterestRates #RealEstateMarket #FirstTimeHomebuyer #FinanceGuide #FixedVsAdjustable #HouseBuyingJourney#Carrerbook#Anslation #SmartBorrowing #MoneyMatters #PersonalFinance #HomeBuying2026 #LoanCalculator #PropertyInvestment

The Truth About Mortgage Rate Fluctuations in 2026

The average interest rate for a 30-year, fixed-rate conforming mortgage loan in the U.S. is…

What’s a good mortgage interest rate in 2026?

The mortgage interest rate climate in 2026 looks completely different than it did just a…

WMT Stock Price Today: Powerful Walmart Share Surge Explained

Walmart Inc. (NYSE: WMT) continues to attract massive attention from investors as its stock price…

How to Fix Disney Plus Not Working (2026 Troubleshooting Guide)

Streaming your favorite movies and shows should be smooth—but when Disney+ stops working, frustration kicks…

Daisy Ridley Movies & Roles Ranked: Best to Latest (2025)

Daisy Ridley has become one of Hollywood’s most versatile actresses, known for her breakout performance…

Apple iOS 26.2: All the Latest Updates, Enhancements & Bug Fixes

Apple continues to refine the iPhone experience with the release of iOS 26.2, a software…