Your CIBIL score has become more important than ever in 2025, especially with banks, NBFCs, and fintech lenders becoming stricter with their loan approvals. Whether you’re planning to apply for a home loan, car loan, credit card, or personal loan, your credit score can instantly make or break your chances. A high score means lower interest rates, faster approvals, and better financial opportunities.

However, if your score is low, don’t worry. The good news is — you can improve your CIBIL score fast, and with the right strategy, you can see positive changes within 30 to 90 days.

How to Improve Your CIBIL Score Fast in 2025 (Step-by-Step Guide)

Below are the most effective and updated methods to boost your CIBIL score quickly in 2025.

Always Pay Your EMIs & Credit Card Bills on Time

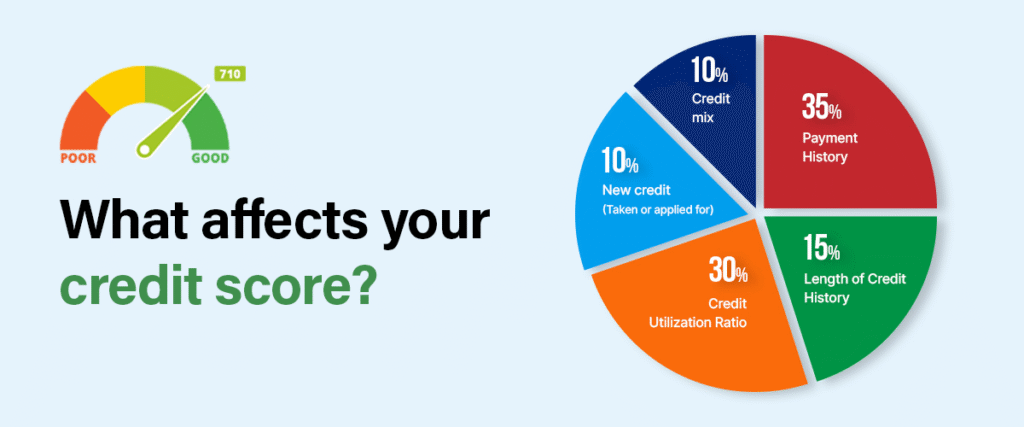

Timely payments account for almost 35% of your CIBIL score, making this the most important factor. Even one missed EMI can drop your score significantly in 2025 due to strict lending algorithms.

What To Do

- Always pay before the due date

- Enable Auto-Debit or Standing Instructions

- Clear at least the minimum due amount on credit cards

Why This Helps

Paying on time builds your reliability and increases your credit trustworthiness.

Keep Your Credit Utilization Ratio Below 30%

Your Credit Utilization Ratio (CUR) is the percentage of your credit limit you use. If you have a ₹1,00,000 limit, don’t use more than ₹30,000 monthly.

What To Do

- Increase your credit limit

- Spend less on your credit cards

- Use multiple cards instead of one

Why This Helps

Lower utilization shows lenders that you are financially disciplined.

Check Your CIBIL Report Regularly for Errors

In 2025, many people see score drops because of incorrect information or fraud in their report.

What To Do

- Download your CIBIL report every 3 months

- Look for wrong entries

- Raise a dispute immediately

https://www.cibil.com/freecibilscore?utm_source=chatgpt.com

Why This Helps

Removing wrong data can increase your score instantly within 7–30 days.

Avoid Applying for Too Many Loans or Credit Cards

Each time you apply, lenders perform a hard inquiry, which reduces your score.

What To Do

- Apply for only 1–2 products per year

- Check your eligibility before applying

Why This Helps

Fewer hard inquiries mean stable creditworthiness.

Maintain a Healthy Credit Mix

CIBIL prefers a balance of secured loans (home/car loan) and unsecured loans (credit cards, personal loans).

What To Do

- Don’t rely only on personal loans

- Maintain long-term loans responsibly

Why This Helps

A balanced profile makes you look like a mature borrower.

Clear Outstanding Dues & Settlements

If you have any “settled” or “written-off” loans, your score is badly impacted.

What To Do

- Pay full outstanding when possible

- Convert high amounts into EMIs

- Request lenders to update status as “Closed”, not “Settled”

Why This Helps

A “closed” status increases your score faster.

Build a Credit History if You’re New

If you are new to credit, your score may be low due to insufficient data.

What To Do

- Get a Secured Credit Card

- Take a small personal loan

- Use BNPL carefully

Why This Helps

Consistent small repayments build a positive credit track record.

https://www.cibil.com/freecibilscore?utm_source=chatgpt.com

Keep Old Credit Accounts Open

Your longest credit account increases your credit age, an important scoring factor.

What To Do

- Do not close your oldest credit card

- Maintain old loan accounts with zero balance

Why This Helps

Longer credit history = higher trust.

How Long Does It Take to Improve CIBIL Score in 2025?

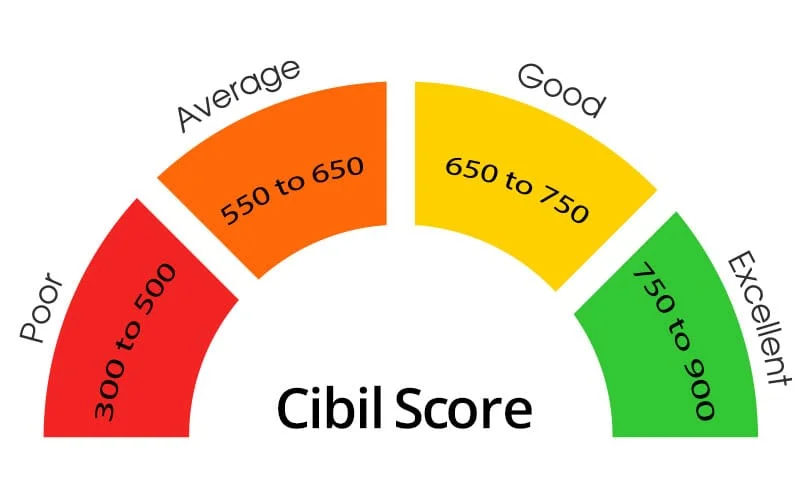

| Score Range | Improvement Time | Notes |

|---|---|---|

| 300–500 | 6–12 months | Major repair needed |

| 500–650 | 3–6 months | Improve utilization & past dues |

| 650–750 | 1–3 months | Small changes show big improvement |

| 750–900 | Already good | Maintain it |

Pro Tips to Boost Your CIBIL Score Quickly

Pay credit card bills twice a month

Reduces utilization faster.

Don’t use more than 10–15% of your limit

Ultra-low usage boosts your score quickly.

Increase credit limit every year

Free and helps improve CUR naturally.

Convert large spends into EMIs

Ensures timely repayment.

Use only 40–50% of your available loans

Shows you are not credit-hungry.

https://www.cibil.com/freecibilscore?utm_source=chatgpt.com

Common Mistakes That Hurt Your CIBIL Score in 2025

- Paying credit card bills late

- Maxing out your credit cards

- Too many loan applications

- High outstanding balances

- Not checking credit report for fraud

- Closing old accounts

- Loan settlements

Avoid these mistakes if you want fast results.

#CIBILScore #CheckCIBIL #CreditScoreIndia #ImproveCreditScore#Carrerbook#Anslation #FinancialHealth #LoanReady #CIBILReport #PersonalFinance #BudgetSmart #CreditAwareness