The Indian Government has revised the income tax slabs for FY 2025-26, bringing major relief for the middle class. The new tax regime is now simpler, more transparent, and offers lower tax rates — especially for individuals earning up to ₹12 lakh per year.

This guide explains the new tax slab in the easiest way possible, along with a clear comparison between the new regime and the old regime, plus real-life examples for better understanding.

What Is the New Income Tax Slab 2025?

The government has announced revised tax slabs under the New Tax Regime, which is now the default option for all taxpayers.

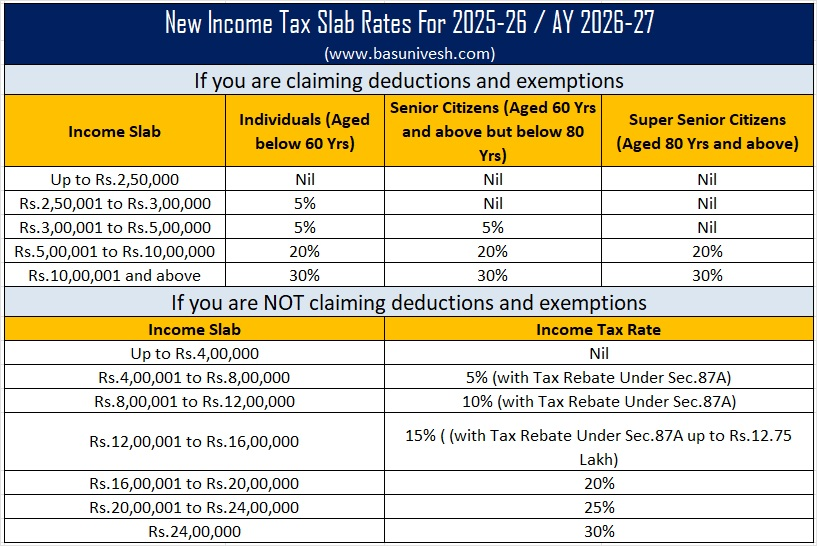

Below is the New Income Tax Slab 2025 (FY 2025-26):

New Tax Regime Slabs (FY 2025-26)

| Annual Taxable Income (₹) | Tax Rate |

|---|---|

| Up to ₹4,00,000 | 0% |

| ₹4,00,001 – ₹8,00,000 | 5% |

| ₹8,00,001 – ₹12,00,000 | 10% |

| ₹12,00,001 – ₹16,00,000 | 15% |

| ₹16,00,001 – ₹20,00,000 | 20% |

| ₹20,00,001 – ₹24,00,000 | 25% |

| Above ₹24,00,000 | 30% |

Major Relief: Tax-Free Income Up to ₹12 Lakh

Under Section 87A rebate, taxpayers with net taxable income up to ₹12 lakh will pay zero tax in the new regime.

This makes the new regime extremely beneficial for middle-income earners.

Old Tax Regime: Still Available

The old regime continues for taxpayers who want to claim deductions such as:

- 80C (LIC, PPF, ELSS, PF)

- 80D (Health Insurance)

- HRA (House Rent Allowance)

- Home Loan Interest

- LTA, Standard Deduction, etc.

Old Regime Slabs (unchanged):

| Income Range (₹) | Tax Rate |

|---|---|

| 0 – 2,50,000 | 0% |

| 2,50,001 – 5,00,000 | 5% |

| 5,00,001 – 10,00,000 | 20% |

| Above 10,00,000 | 30% |

New Regime vs Old Regime: Which Is Better?

Choose New Regime If:

- Your income is below ₹12 lakh

- You don’t claim many deductions

- You want simpler tax filing

- Your investments are low

Choose Old Regime If:

- You claim heavy deductions (₹2–3 lakh or more)

- You pay home loan interest

- You receive significant HRA benefit

- You invest regularly under 80C, 80D, etc.

Real-Life Examples: Tax Calculation Under New Slab

Below are simplified examples to help you clearly understand the new system.

To help you understand the New Tax Regime 2025, here are four simple examples with step-by-step explanations. Each example shows how tax is calculated based on income slabs and where the rebate applies.

Example 1: Income ₹8,00,000 — Why Tax Becomes Zero

When your income is ₹8 lakh, it falls under the lower tax slabs.

Let’s break it down:

How the tax is calculated:

- First ₹4,00,000 → 0% tax, so no tax.

- Next ₹4,00,000 → 5% tax, which becomes ₹20,000.

Total tax before rebate: ₹20,000

But because the government now gives a rebate for incomes up to ₹12 lakh, your entire calculated tax becomes zero.

Final Tax Payable: ₹0

Meaning: If you earn ₹8 lakh yearly, you don’t have to pay any income tax.

Example 2: Income ₹12,00,000 — Why Still No Tax

Even at ₹12 lakh income, your overall tax is still fully waived due to the rebate.

Tax calculation:

- 0% on first ₹4 lakh = ₹0

- 5% on ₹4–8 lakh = ₹20,000

- 10% on ₹8–12 lakh = ₹40,000

Total tax before rebate: ₹60,000

Since your income does not exceed ₹12 lakh, the rebate covers the entire ₹60,000 tax.

Final Tax Payable: ₹0

Meaning: Even with a ₹12 lakh salary, you don’t pay tax under the new regime.

Example 3: Income ₹18,00,000 — Why You Pay Tax

Here the income crosses ₹12 lakh, so rebate doesn’t apply.

This means whatever tax you calculate must be paid.

Tax calculation:

- 0% on 0–4 lakh = ₹0

- 5% on 4–8 lakh = ₹20,000

- 10% on 8–12 lakh = ₹40,000

- 15% on 12–16 lakh = ₹60,000

- 20% on 16–18 lakh = ₹40,000

Total Tax Payable: ₹1,60,000

Meaning: Since your income is above ₹12 lakh, rebate is not available and full tax must be paid.

Example 4: Income ₹30,00,000 — Higher Income, Higher Tax

As income increases, it enters higher tax slabs. That’s why the tax rises sharply for this income group.

Step-by-step calculation:

- First ₹4 lakh → 0% = ₹0

- Next ₹4 lakh (4–8 lakh) → 5% = ₹20,000

- Next ₹4 lakh (8–12 lakh) → 10% = ₹40,000

- Next ₹4 lakh (12–16 lakh) → 15% = ₹60,000

- Next ₹4 lakh (16–20 lakh) → 20% = ₹80,000

- Next ₹4 lakh (20–24 lakh) → 25% = ₹1,50,000

- Last ₹6 lakh (24–30 lakh) → 30% = ₹1,80,000

Total Tax Payable: ₹4,30,000

Meaning: Higher income enters multiple tax slabs, making total tax significantly higher.

- Up to ₹12 lakh income → No tax (rebate applies).

- Above ₹12 lakh income → You pay tax as per slab rates.

- Tax is always calculated slab-by-slab, not on the entire income at one rate.

Additional Points to Remember

- New Regime is default, but you may switch to old regime while filing ITR.

- Deductions like 80C, HRA, 80D are not allowed in the new regime.

- Capital gains tax is separate and not part of income tax slabs.

- Salaried taxpayers can compare both regimes at the time of filing.

New Income Tax Regime (FY 2025–26 / AY 2026–27)

This is the default tax system from 2025 onwards.

| Annual Taxable Income (₹) | Tax Rate |

|---|---|

| Up to ₹4,00,000 | 0% (No Tax) |

| ₹4,00,001 – ₹8,00,000 | 5% |

| ₹8,00,001 – ₹12,00,000 | 10% |

| ₹12,00,001 – ₹16,00,000 | 15% |

| ₹16,00,001 – ₹20,00,000 | 20% |

| ₹20,00,001 – ₹24,00,000 | 25% |

| Above ₹24,00,000 | 30% |

https://cleartax.in/s/old-tax-regime-vs-new-tax-regime?utm_source=chatgpt.com

Section 87A Rebate

- If your net taxable income ≤ ₹12 lakh, your tax becomes ZERO after rebate.

- This makes income up to ₹12 lakh effectively tax-free in many cases under the new regime.

Old Tax Regime

You can still choose this regime if you want deductions & exemptions like:

- 80C (PF, LIC, ELSS, tuition fees, etc.)

- 80D (Health insurance)

- HRA

- Home loan interest

- Standard Deduction, etc.

| Annual Income (₹) | Tax Rate |

|---|---|

| Up to ₹2,50,000 | 0% |

| ₹2,50,001 – ₹5,00,000 | 5% |

| ₹5,00,001 – ₹10,00,000 | 20% |

| Above ₹10,00,000 | 30% |

https://cleartax.in/s/old-tax-regime-vs-new-tax-regime?utm_source=chatgpt.com

The Income Tax New Slab 2025 is designed to simplify tax filing and reduce the tax burden for middle-class earners. With income up to ₹12 lakh becoming tax-free, many individuals will pay little to no tax in FY 2025-26.

However, the “best tax regime” depends on your yearly investments, deductions, and financial structure. Comparing both regimes before filing your ITR can help you make the most tax-efficient choice.

#IncomeTax2025 #TaxSlab2025 #IncomeTaxNewRegime #FinanceNews #TaxUpdate2025 #IncomeTaxIndia #Budget2025 #TaxpayerIndia #PersonalFinanceIndia #FinanceTips#Carrerbook#Anslation #MoneyMatters #IncomeTaxReturn #TaxSaving2025 #FinancialPlanning #NewTaxRegime2025 #TaxGuideIndia #ITR2025 #TaxAwareness #TaxBenefits #FinanceBlog